Accounting Management simplifies the process of recording transactions, managing payables and receivables, collecting taxes, and closing the books. It also enables timely and accurate reporting, allowing for greater control of financial assets. By providing real-time access to financial data, one can easily navigate through details to resolve issues, generate statements, and comply with multiple regulatory financial compliance requirements. Combine core accounting functionalities such as general ledger, accounts receivable, accounts payable, tax management, fixed assets management, cash management, and payment management seamlessly. Gain real-time visibility and valuable business insights to drive financial excellence.

All in One Place

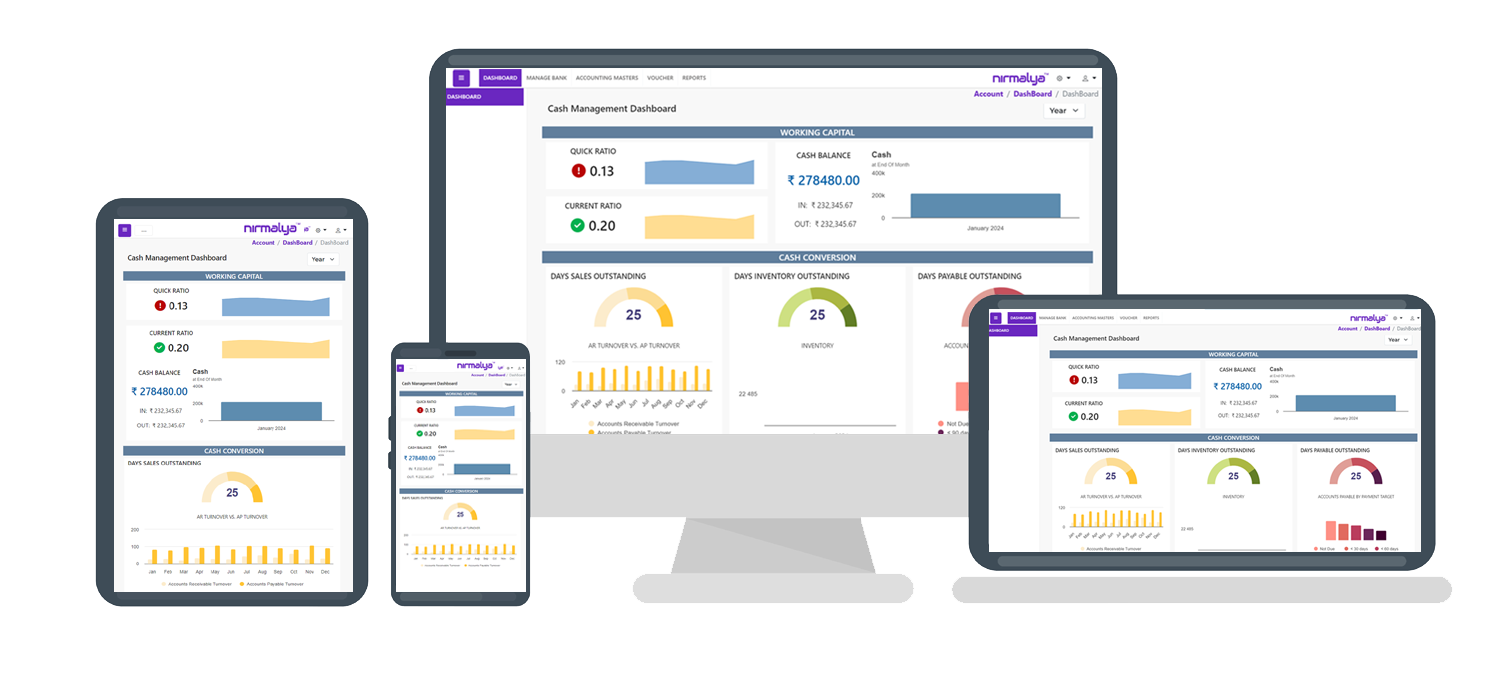

Obtain real-time and comprehensive analysis of various financial indicators, including profitability ratios, inventory margins, liabilities, fixed assets, taxes, and cash positions, guaranteeing compliance with accounting standards, government regulations, tax codes, and internal policies.

Optimise Resources

Automate monotonous tasks, such as generating journal entries or reconciling account statements, and eliminate the necessity to gather and standardize data from other departments for the purpose of enhancing human resources efficiency.

Manage Global Business

Easily handle numerous subsidiaries, business units, and legal entities using a single integrated platform. Gain instant visibility at local, regional, and headquarter levels, and streamline business procedures across all divisions and subsidiaries.

Unified

Bringing data, technology & expertise together to transform your business and make future-ready.

Connected

Integrating different varieties of data to enhance transparency, insights, and transform digitally to capitalize on data and innovate without boundaries.

Interoperable

Reliable & Resilient – your platform & partner for digital transformation without limits.