Finance teams can effortlessly generate detailed reports that analyse transactions in real-time, including line-item tax details. It streamlines global tax compliance, resulting in time savings, reduced costs, and the elimination of manual calculations. Our pre-built tax logic automates taxability determinations and calculations for every transaction, even at the individual item level. With this, domestic and global tax management becomes simple and easy, providing detailed reports that analyse transactions in real-time, including line-item tax details. It also facilitates the handling of local taxes across subsidiaries and supports multiple tax schedules for various taxes like GST, TDS, VAT, consumption tax, and general sales tax.

Diverse Taxation

Effectively manage various local taxes in different subsidiary companies, encompassing GST, VAT, withholding, and sales taxes.

Policy Management

Enable accounting, purchasing, and sales teams to confidently handle tax procedures in compliance with country-specific regulations.

Ensuring Compliance

Seamlessly integrate transaction tax determination and reporting capabilities for sales, billing, revenue recognition, payment processing, and numerous other functions.

Unified

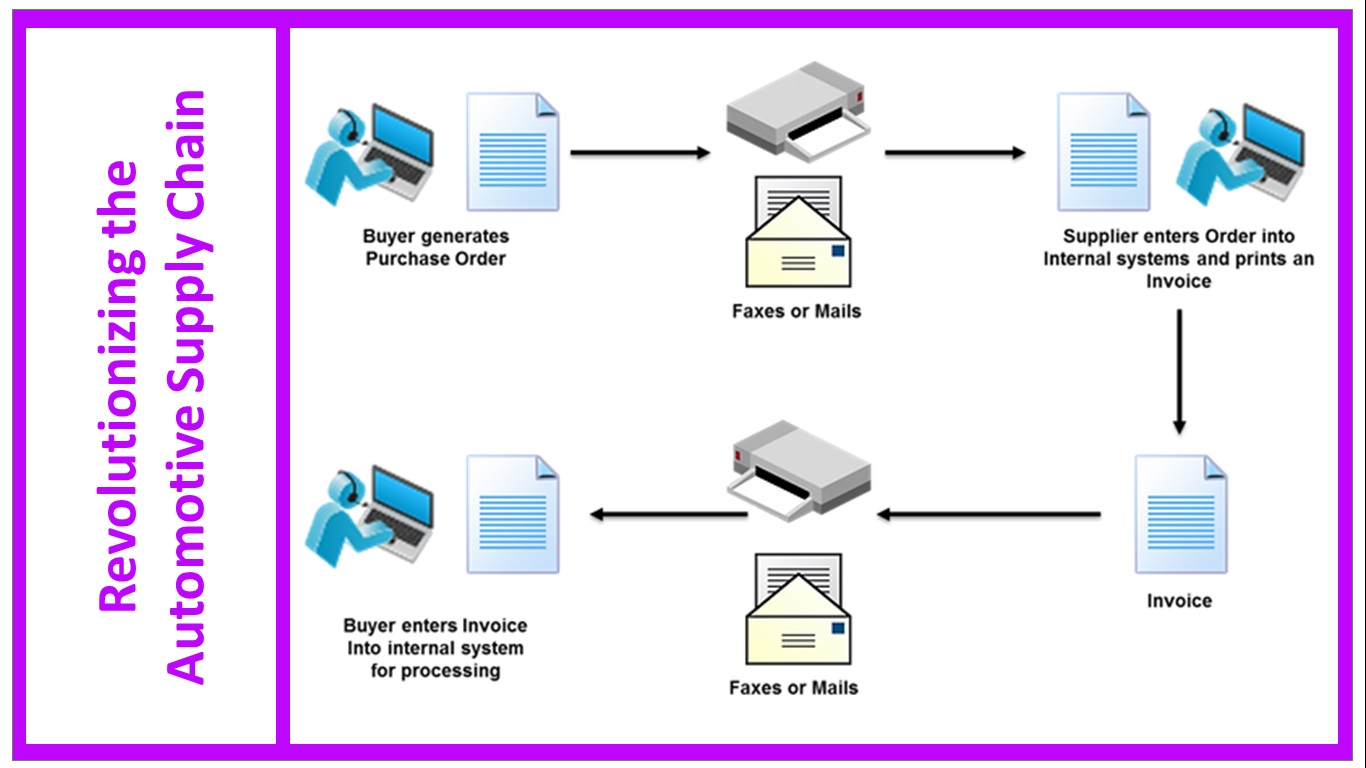

Bringing data, technology & expertise together to transform your business and make future-ready.

Connected

Integrating different varieties of data to enhance transparency, insights, and transform digitally to capitalize on data and innovate without boundaries.

Interoperable

Reliable & Resilient – your platform & partner for digital transformation without limits.

.jpg)