Cash management offers instant access to bank and credit card information, expedites the reconciliation procedure, and enhances the efficiency of the accounting team. By facilitating automatic imports, it presents an accurate depiction of the current cash status, enabling finance professionals to optimize working capital, forecast cash needs, and generate precise reports. To optimize cash flows, monitor bank accounts, manage liquidity, and make well-informed decisions, finance teams require both visibility and reporting tools. This solution provides a comprehensive overview of the company's cash flows and cash position, allowing finance teams to adopt a more strategic approach than ever before.

Manage

Streamline the process of importing bank and credit card data from financial institutions to provide a comprehensive overview of daily cash availability for finance personnel.

Reconcile

Simplify and expedite the process of reconciling bank and credit statements with general ledger accounts, minimizing both time and effort required.

Posting

Facilitate the automatic posting of transactions from imported bank and credit card data, allowing users to define specific criteria for seamless integration.

Unified

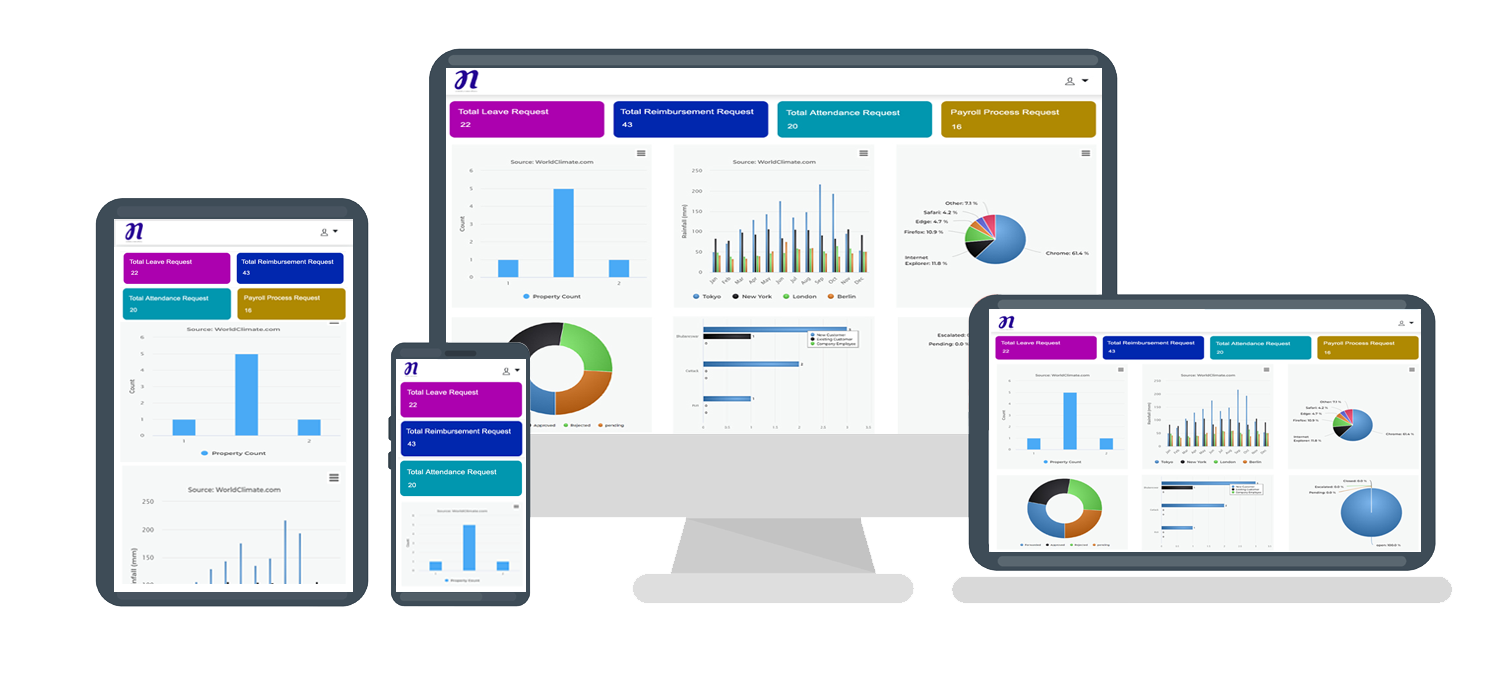

Bringing data, technology & expertise together to transform your business and make future-ready.

Connected

Integrating different varieties of data to enhance transparency, insights, and transform digitally to capitalize on data and innovate without boundaries.

Interoperable

Reliable & Resilient – your platform & partner for digital transformation without limits.

.jpg)